Apple introduces a new kind of credit card in partnership with Goldman Sachs and MasterCard. Currently, Apple Card will only be available for US customers and will make its way to Australia soon.

The company hopes that users will use Apple to pay more and transact within the iOS ecosystem. CEO Tim Cook described it as the “Most significant change in the world of credit cards in the last 50 years”. With its several new moves, it is now extending its reach to the iPhone user base trying to keep them engaged with its offerings.

Let’s see all about Apple Credit card; how it would affect payments, credit card market and more…

Virtual & Physical Apple Card

People can make transactions via virtual card using Apple pay and through physical Apple Card as well. Physical Apple Card looks fantastic, built of titanium. The design is simple and will contain only:

- Owner’ name

- A chip

- A magnetic strip on its backside

- Apple logo on it

So there will be no CVV number, Card number, Signature, and Expiration date mentioned on the card.

There will be no number on the card, however, the app will display only last 4 digits of the card number. Also, you may get a virtual card number and CVV number in the app to use for any purchase. It is semi-permanent which means you can regenerate it at any time. This will be very useful in situations where you have to share your card number unwillingly.

No Penalty and lowest Interest

Apple will not charge any fee including the annual fee, late fine, international fee or over-the-limit fee. Also, it claims the lowest interest rate in the market. In fact, the replacement of your physical card is free. Moreover, the Exchange rate will be determined by the MasterCard in the case of foreign transactions.

Rewards on Every Transaction

- 3% cashback on Apple Purchase

- 2% cashback on paying via Apple Pay

- 1% cashback for transactions via Physical card

On using it for purchase you will get cashback on an everyday basis and there will be no limit for this. Also, you can use it like cash as it will be available on Apple cash (Available only in the US).

Apple App Will Be Used To Access Its Full Functionality

To avail all the benefits from your Apple Card, it is advised to use the apple application. You can get the detailed list of your transactions, payment reminders, trend reports, track your reward points and many more. You can also receive customer service communications through text message by sending a request.

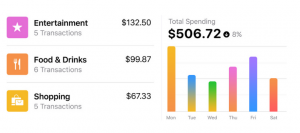

Easy To Track on Your Spending

Apple app will help you to track your spending in a fun way. In spending summaries, you can see how much you have spent on a particular category in a different color. If you see more orange color on your display, it means you have spent lots of bucks on your food and drinks.

How Secure Is It?

You need your device number to purchase anything. Also, the one-time code will be generated by your iPhone at the time you purchase. You can authorize your purchase with Face ID or touch ID so that not anyone can use your card.

Apple Cash Is Not Needed to Pay the Bill

You can pay your bill through ACH from a bank. However, the cashback and rewards you have earned can be used as your balance if you want.

Is Apple Credit Card Really A Game Changer?

Though the features sound attractive but some of these are already available with other credit cards in the US market. Howsoever, the features and offers are not a game changer as per experts who were hoping it would make a big move in the way people are making payments but it will boost Apple Pay wallet as it is inspired to keep the money inside the Apple ecosystem and will bring profits to the company in long run that may be dangerous for card networks. Peter Berg, an American writer, and director twitted as:

Apple pushing people to keep cash inside the Apple ecosystem is not to be underestimated!

They are playing a long game here. If successful, this is very bad for the card networks.

— Peter Berg (@peter) March 26, 2019

All in all, with Apple credit card, cable packages, and Magazines Subscription; Company is embracing people on daily life with its services as well just like smartphones. So it may not be a revolutionary transformation in credit card and payment world, but it will definitely give a surge to Apple wallet. Experts speculate that in the future, Apple would bundle it with its other services like iCloud, Apple warranty and Apple music to come up with a discounted Apple bundle.

Tap To Login and Enjoy the Shopping

This summer, you could just sign-up for the card and as you can use it through Apple pay you don’t have to wait for the physical credit card. Once the approval is done, you can make transactions through the wallet.